The IEA Global Hydrogen Review 2024 offers a comprehensive view of the hydrogen sector’s current state, achievements, and challenges. Here’s an exploration of the 10 key takeaways from the report, emphasizing their implications for the future of hydrogen technologies and markets.

1. Growing Global Hydrogen Demand

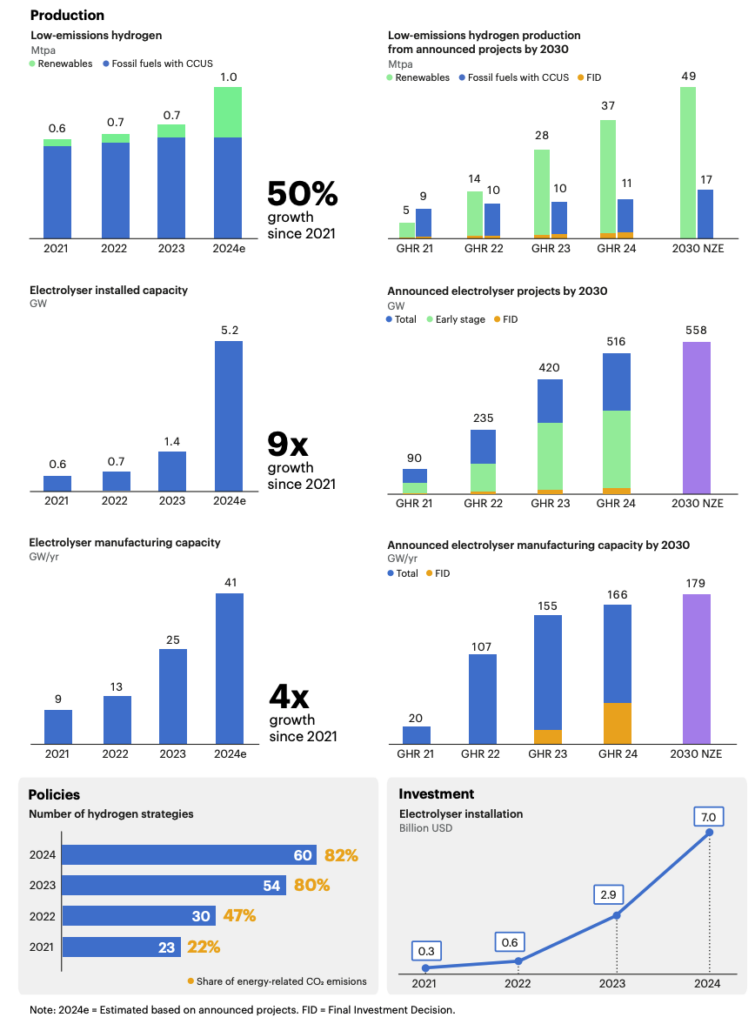

Global hydrogen demand reached 97 million tonnes (Mt) in 2023, marking a 2.5% increase from 2022. However, over 95% of this demand is still met by hydrogen derived from unabated fossil fuels, which contributes significantly to CO₂ emissions. Transitioning this demand to low-emissions hydrogen is vital for achieving climate goals.

Actionable Path Forward:

- Governments must focus on demand-side policies like carbon pricing and hydrogen quotas in industrial applications.

- Industry players can adopt hydrogen as a cleaner substitute in sectors like steel production, where fossil fuels dominate today.

2. Rise of Electrolysis Projects

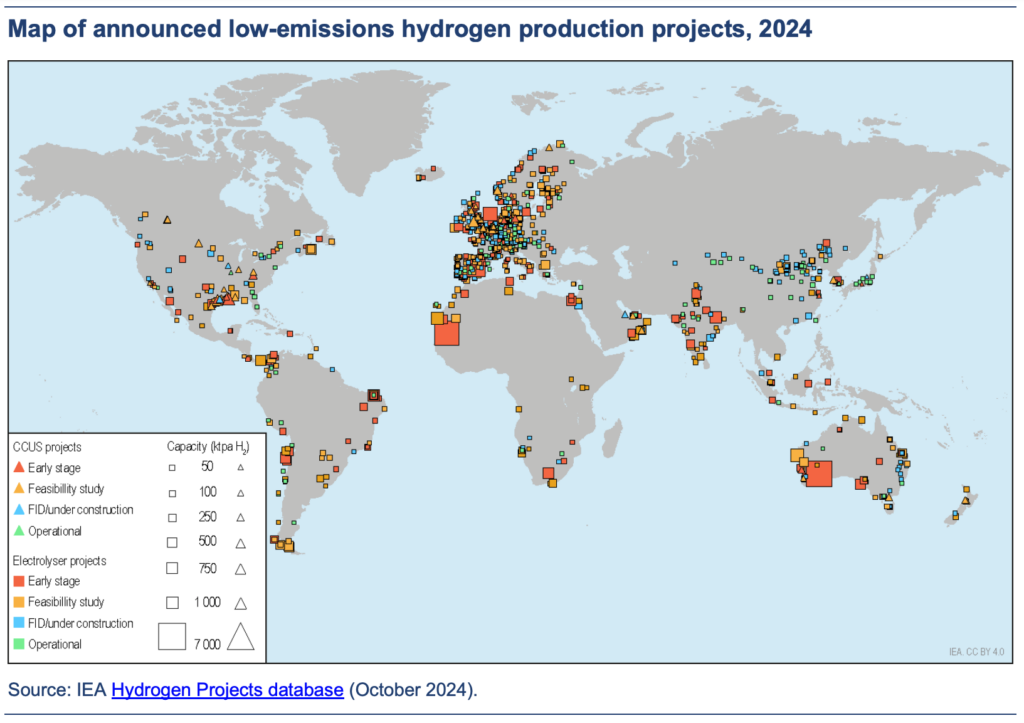

Electrolysis has emerged as the dominant technology for low-emissions hydrogen production, with planned projects expected to yield nearly 520 GW of electrolyser capacity by 2030. Final Investment Decisions (FIDs) for projects have doubled over the past year, signaling growing confidence in the technology.

Challenges:

- Scaling up requires overcoming hurdles like securing green electricity, addressing infrastructure bottlenecks, and reducing CAPEX costs.

- Developers face delays caused by complex permitting processes and regulatory uncertainties.

3. China’s Leadership in Electrolyser Manufacturing

China’s dominance in electrolyser production (60% of global capacity) mirrors its earlier successes in solar PV and battery manufacturing. This positioning allows China to drive cost reductions globally, potentially making electrolysis-based hydrogen more affordable.

Global Implications:

- Other regions, like Europe and India, are ramping up their own capacities, with notable Final Investment Decisions in electrolyser manufacturing.

- Diversifying manufacturing bases could strengthen resilience against supply chain disruptions.

4. Innovation Fuels Sectoral Growth

Governments have significantly increased R&D investments since 2016, leading to breakthroughs in end-use applications like fuel cells, ammonia-based shipping, and hydrogen-based steelmaking. Patent filings for hydrogen-related technologies surged by 47% in 2022, indicating strong innovation momentum.

Future Opportunities:

- Accelerating technology adoption in hard-to-abate sectors like aviation and maritime transport.

- Strengthening public-private partnerships to commercialize promising innovations.

5. Cost Competitiveness Challenges

- Scaling up production facilities to achieve economies of scale.

- Leveraging financial tools like Carbon Contracts for Difference (CCfDs) to address the cost gap between green hydrogen and fossil-based alternatives.

6. Demand Creation Lags Behind Supply

Government targets for hydrogen production (43 Mtpa by 2030) far exceed demand targets (11 Mtpa), highlighting a critical mismatch. Policies to stimulate demand remain underdeveloped compared to supply-side incentives.

Call to Action:

- Increase policy support for hydrogen usage in industrial hubs and transportation.

- Foster private-sector initiatives like long-term offtake agreements and hydrogen purchasing tenders.

7. Advancing Certification Standards

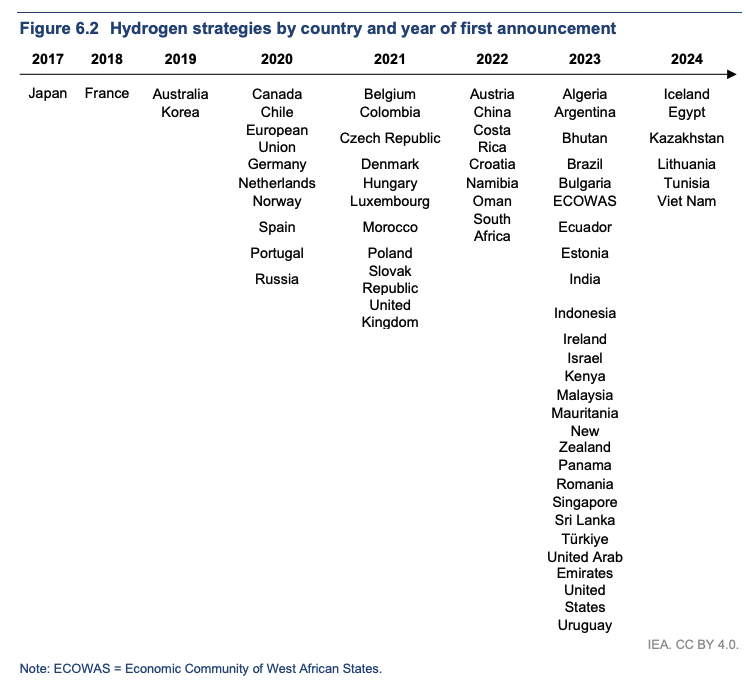

As global trade in hydrogen expands, clear and harmonized certification standards are essential. The International Organization for Standardization (ISO) is working on methodologies for greenhouse gas emissions accounting, a crucial step toward aligning regional frameworks.

Focus Areas:

- Accelerate mutual recognition of certification schemes across regions to avoid market fragmentation.

- Address gaps in upstream emissions data, particularly for fossil-based hydrogen with carbon capture.

8. Latin America’s Untapped Potential

Latin America has the resources to become a global leader in low-emissions hydrogen production, thanks to its abundant renewable energy potential and existing industrial base. By 2030, the region could produce 7 Mtpa of low-carbon hydrogen, but achieving this requires massive investments in infrastructure and renewable energy generation.

Key Opportunities:

- Develop hydrogen hubs near industrial centers to stimulate both domestic and export markets.

- Update national hydrogen strategies to align with emerging global trade patterns.

9. Infrastructure as a Bottleneck

- Prioritize repurposing existing natural gas pipelines to reduce costs and speed deployment.

- Encourage public-private partnerships for large-scale infrastructure projects, leveraging shared investments.

10. Industrial Hubs as Catalysts

Industrial hubs—regions with high concentrations of hydrogen producers and consumers—are ideal for scaling hydrogen deployment. These hubs minimize infrastructure needs and offtake risks while creating economies of scale.

Strategic Focus:

- Governments should target industrial hubs with co-located hydrogen demand and supply chains.

- Leverage public procurement to stimulate the market for hydrogen-based products like green steel and ammonia.

The road ahead: recommendations for stakeholders

- Governments: Adopt integrated policies that balance demand stimulation with supply-side incentives, focusing on infrastructure and certification alignment.

- Industry: Prioritize collaboration on large-scale projects, leveraging industrial hubs as launchpads for low-emissions hydrogen technologies.

- Investors: Support projects with clear regulatory frameworks and strong offtake agreements to ensure stable returns.

- Communities: Engage local stakeholders early in project development to build public support and foster job creation in emerging hydrogen economies.

Hydrogen’s transformative potential in the clean energy transition is undeniable. However, achieving its promise requires a concerted effort across governments, industries, and civil society to address the outlined challenges while leveraging emerging opportunities.

The IEA’s report underscores hydrogen’s pivotal role in the clean energy transition. By addressing these challenges and seizing opportunities, governments, industries, and stakeholders can unlock its full potential for a sustainable future.

For an in-depth exploration of these trends and more, visit the IEA’s Global Hydrogen Review 2024: IEA (2024), Global Hydrogen Review 2024, IEA, Paris https://www.iea.org/reports/global-hydrogen-review-2024, Licence: CC BY 4.0