Economic Viability and Market Potential of Hydrogen Fuel Cells

As the world pivots towards sustainable energy solutions, hydrogen fuel cells are emerging as a promising technology with the potential to revolutionize various sectors. For decision-makers and stakeholders across the value chain, understanding the economic viability and market potential of hydrogen fuel cells is crucial for making informed investment and policy decisions. This article delves into the key factors influencing the adoption of hydrogen fuel cells and their market prospects. We will, therefore go through key factors such as Cost structure, market projections, policy dynamics, etc.

The road towards market maturity: a cost challenge

While talking about new energetic solutions, and new technologies or products in general, price and cost are two main pillars for market deployment and perpetuation. In other words, hydrogen fuel cells, while technologically advanced, face significant cost challenges that need to be addressed to ensure widespread adoption. The primary components contributing to the cost include the fuel cell stack, balance of plant, and hydrogen production. Currently, the production cost of green hydrogen, derived from renewable sources through electrolysis, is approximately $3-5 per kilogram. This high cost is primarily due to the expense of renewable electricity, which constitutes 60-70% of the total production cost.

For hydrogen fuel cells to become economically viable, the cost of green hydrogen must fall below $2 per kilogram. Technological advancements in electrolyzers and economies of scale in renewable energy production are essential to achieving this target. Investments in research and development (R&D) and infrastructure are pivotal in driving down these costs. What’s more, this need for costs permitting a wide adoption is exacerbated by a continuous growth in demand.

A green hydrogen exponential need: market outlook

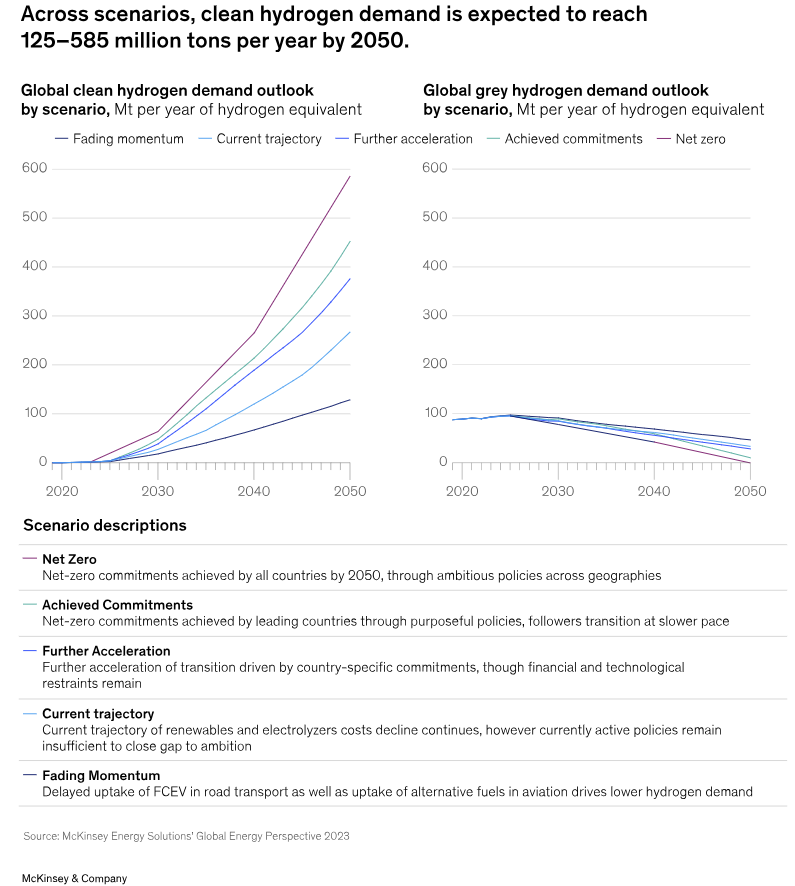

Despite current cost barriers, the market potential for hydrogen fuel cells is substantial. According to a McKinsey report, by 2050, hydrogen demand could reach 80 million tons per annum (Mtpa) for road transport and 50 Mtpa for aviation under a scenario of accelerated adoption. This growth is driven by the need to decarbonize hard-to-abate sectors and the increasing political and business momentum towards clean energy transitions.

In the near term, the industrial sector, particularly in applications such as steel production, ammonia synthesis, and refining, is expected to be a significant driver of hydrogen demand. The transportation sector, including heavy-duty trucks, buses, and trains, is also poised for substantial growth as fuel cell technology matures and becomes more cost-competitive with battery electric vehicles. This dynamic is also driven and encouraged by committed political strategies and policy support for green hydrogen wide spreading.

Policy and Regulatory Support

Government policies and incentives play a critical role in accelerating the adoption of hydrogen fuel cells. In the United States, the Inflation Reduction Act provides substantial tax credits of up to $3 per kilogram for hydrogen produced with low lifecycle greenhouse gas emissions. Similarly, the European Union’s Renewable Energy Directive (RED) includes stringent guidelines for green hydrogen production, promoting investments in renewable energy and hydrogen infrastructure. To give a more specific example, one rule of the RED is about geographical correlation. In other words, the solar panels or wind turbines that feed the electrolyzer must be close by – that is, in the same bidding zone. That is likely to limit the use of Power Price Agreements (PPAs) that span multiple bidding zones or even countries, which is currently common practice (for example, using green hydropower from Norway in the Netherlands through a PPA).

These policy measures not only provide financial incentives but also create a regulatory framework that ensures the sustainability and environmental benefits of hydrogen fuel cells. Clear and supportive policies are essential to de-risk investments and encourage private sector participation in the hydrogen economy.

A correlative infrastructures development

The successful deployment of hydrogen fuel cells requires significant infrastructure investments, including production facilities, distribution networks, and refueling stations. The development of hydrogen hubs, where production, use, and export of green hydrogen are co-located, is a strategic approach to overcoming initial infrastructure challenges. For instance, Europe alone will need over 40,000 kilometers of hydrogen pipelines and 163,000 refueling stations for trucks by 2050 to meet projected demand.

Public-private partnerships and international cooperation are critical to building this infrastructure. Collaborative efforts can help share the financial burden and leverage expertise across different sectors and regions.

Competitive Dynamics and Market Opportunities

To finish with, hydrogen fuel cells face competition from other clean technologies, such as battery electric vehicles and biofuels. The relative competitiveness of hydrogen will depend on technological advancements, cost reductions, and the availability of enabling infrastructure. For example, hydrogen’s role in decarbonizing aviation will hinge on its ability to compete with sustainable aviation fuels (SAFs).

Nonetheless, hydrogen fuel cells offer unique advantages, particularly in applications requiring high energy density and fast refueling times. They are well-suited for long-haul transportation, industrial processes, and as a storage solution for renewable energy. As such, they hold significant market potential in these niche areas where other technologies may not be as effective.

To put it in a nutshell, hydrogen fuel cells represent a transformative opportunity for achieving a sustainable energy future. While current economic challenges and infrastructure needs are significant, the long-term market potential is substantial. For decision-makers and value-chain stakeholders, strategic investments in R&D, infrastructure, and supportive policies are essential to unlocking the economic viability of hydrogen fuel cells. By addressing these challenges and capitalizing on market opportunities, hydrogen fuel cells can become a cornerstone of the global clean energy transition.